- #Free income and expense software for small business license

- #Free income and expense software for small business professional

- #Free income and expense software for small business free

A large amount of a salon’s revenue comes from product sales, so it’s important to have enough inventory ready for your employees to make add-on sales and recommendations. This is not the stock that your employees use on clients, it’s your supply of retail products. If you also run a nail salon, you’ll want to budget for the cost of specialty polishes and manicure products, too. A salon's back bar supplies typically include shampoos, sanitizers, conditioners, styling products, and any chemicals used during services (such as perm solution and hair color).

Remember to include these business costs in your monthly costs/ expense budget. When you start up your salon business, you should have enough beauty supplies and basic tools ready for each employee to use. A reliable internet connection is important for things like processing payments, maintaining your salon’s social media presence, and doing any online marketing. In addition, you’ll have to consider the cost of internet service and a phone line.

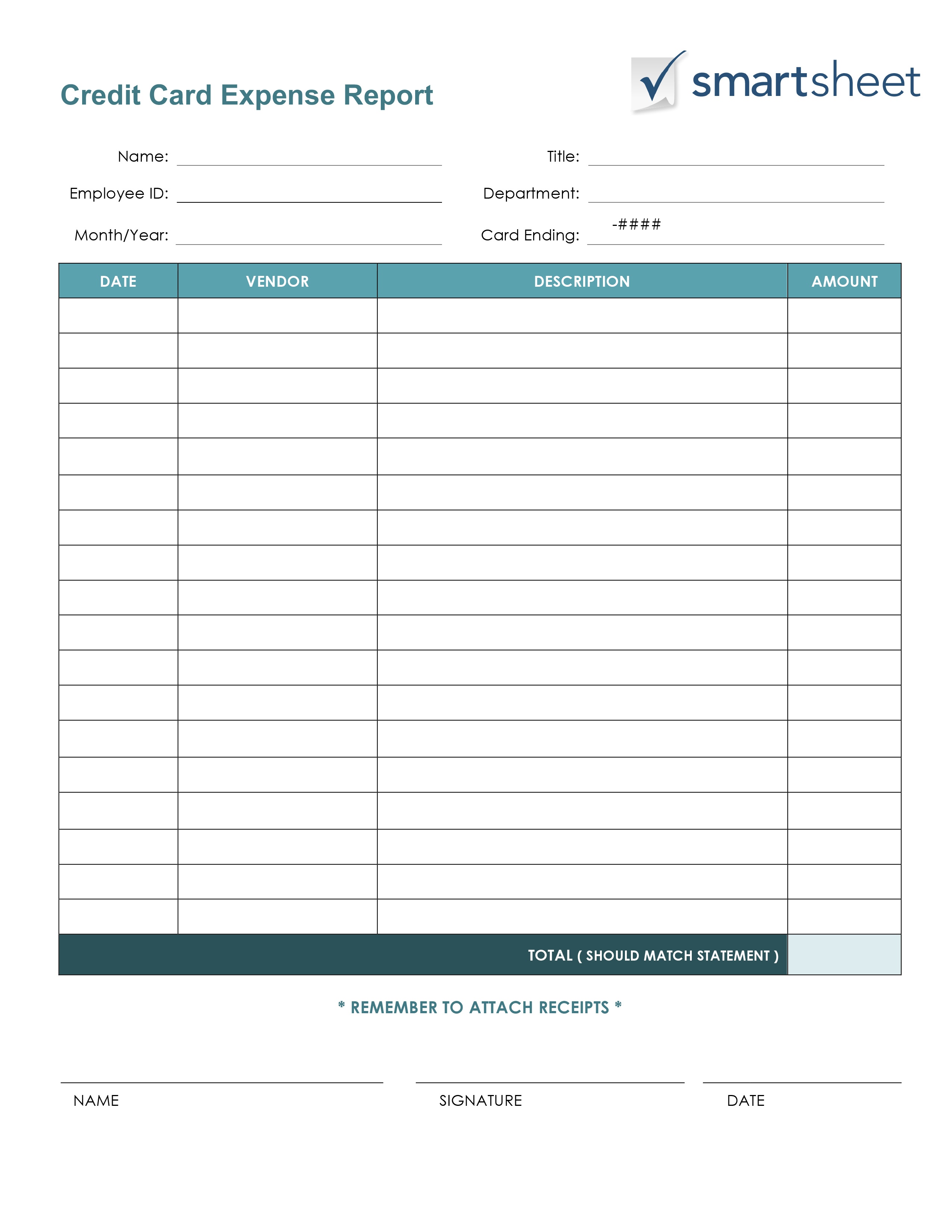

To give you an idea, the average electricity bill for a salon starts at around $150 per month, and water bills can cost from $45 to over $150 for the largest and busiest salons. So, it’s a good idea to look up the average costs for these services in your area. Salons all need electricity, water and heat, of course. No matter what services they offer, or what industry they’re in, businesses all have to pay for utilities. A POS system is important for processing transactions, but remember that it might also need specific equipment (such as iPads, if it uses wifi), and receipt paper. Decide on exactly what metrics you want to track (for example, do you want to know when your product stock should be reordered, what appointments are coming up, or how much revenue each stylist has generated, so far)? Once you know this, you can find something that fits your requirements. These systems vary in cost, depending on your salon's needs. Plus, it’s a great way to build employee loyalty.

#Free income and expense software for small business license

A new training course or license won’t be free, but if salon owners work with each employee and choose carefully, the long-term profits from education investments will add a lot to your revenue and raise your salon’s monthly income. The beauty industry is always changing, and this means that businesses need to keep up. Salons often seek out new training to stay up to date with the latest beauty service trends or techniques.

#Free income and expense software for small business professional

Most likely, you’ll eventually want to invest in some additional education, training, or professional development for each stylist at your business. Check your state’s website and the website for your city to see what’s required.

#Free income and expense software for small business free

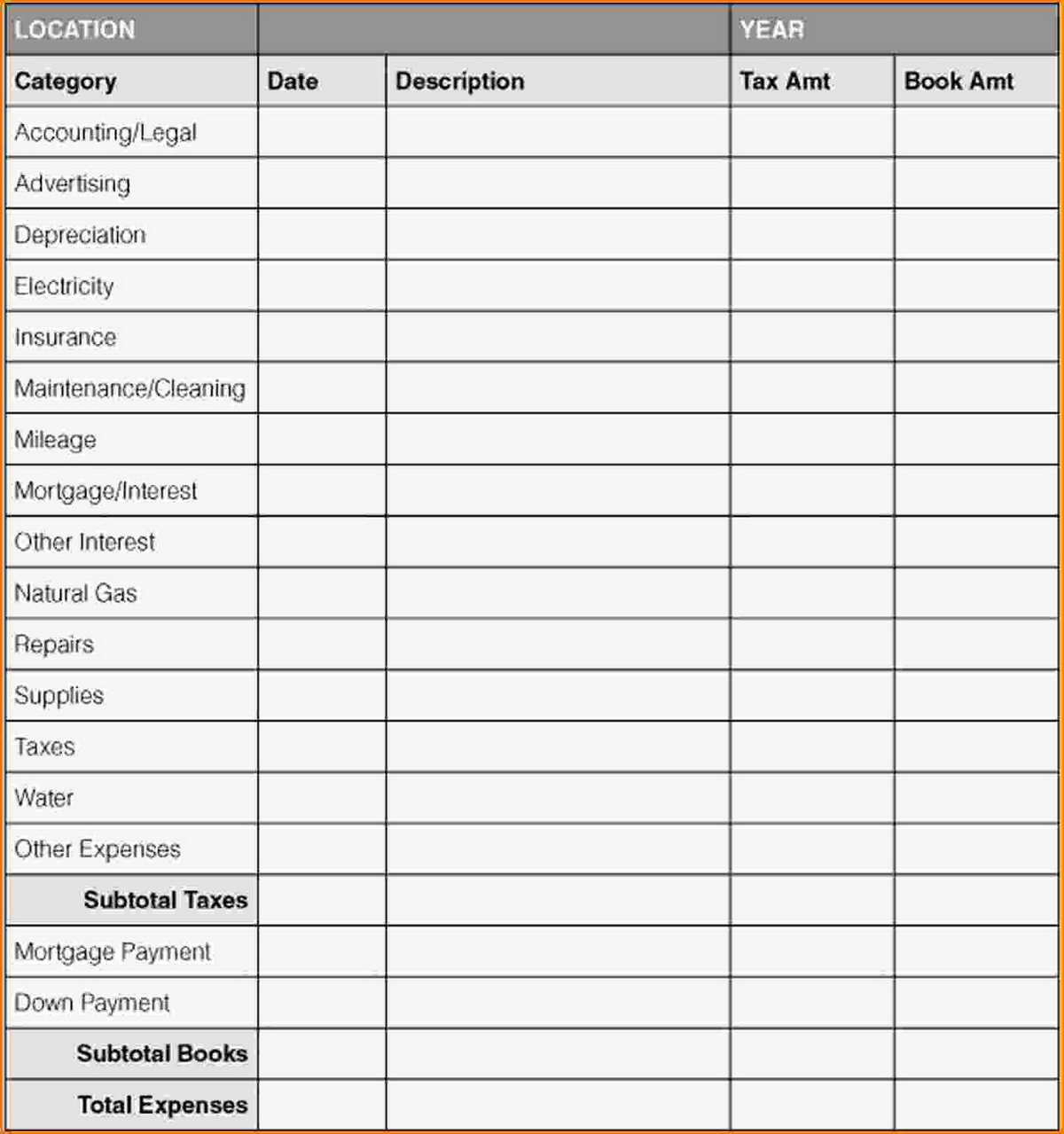

In some places, you’ll be free to sell retail products related to your salon, but in other locations, you will need to pay for a permit. You will probably need health and safety inspections and certificates. If you’re able to save on rent, this will add a lot more money to your overall revenue by reducing the overhead expense.īusiness licenses are necessary, but they vary depending on the city, state, or province. Businesses usually pay higher rent than residential properties, so it’s important to stay informed and have a dollar amount in mind when you plan your salon’s budget. If you’re still choosing a salon business location, check out the average rent prices in your area online. Make sure and do some research about what’s required in your area and set aside some money to cover these costs.ĭo not miss our post on Hairstylist Tax Write Offs. These costs will vary, depending on your business location. This can quickly add up if you have a lot of staff. People often ask “What is the largest expense in operating a salon?” The answer is usually salaries. Some Salon Monthly Recurring Expenses Are: These costs are easier to budget for, especially if you use salon software to track your business expenses in one place. Recurring expenses are the costs that you can expect to pay regularly, usually every month. Let’s start with a breakdown of recurring expenses. They’re the average costs that have to be paid each month, so you’ll have a good idea of how each recurring expense will impact your revenue profits and bottom line. Recurring expenses, however, can and should be accounted for. While it’s important to keep an eye on a salon’s occasional expenses, it’s not always possible to predict exactly what these fees will be, or how they will affect your profit margins. Salon expenses can be divided into two categories: Recurring Expenses and Occasional Expenses.

0 kommentar(er)

0 kommentar(er)